Apple Pay is now available in Canada exclusively for American Express customers, allowing newer iPhone and Apple Watch owners to make contactless payments at stores like Indigo, McDonald's, Sport Chek, Tim Hortons and others that have NFC-equipped payment terminals and accept American Express.

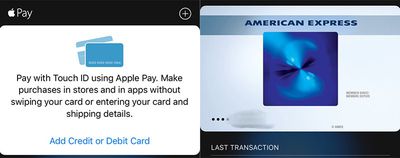

Apple Pay should now be live in the Wallet app on iOS 9.1 for Canadian users. American Express cards can be scanned or added manually by tapping the "Add Credit or Debit Card" option.

American Express, an independent credit card issuer in Canada, is not nearly as popular or widely accepted as MasterCard or Visa credit cards in the country, and Apple notes that bank-issued American Express cards like those in partnership with Scotiabank are not accepted at launch.

Apple has reportedly been in talks with six large Canadian banks about launching Apple Pay north of the U.S. border, including the Royal Bank of Canada, TD Canada Trust, Scotiabank, Bank of Montreal, CIBC and National Bank of Canada, but negotiations have reportedly been dragging.

TD Canada Trust prematurely leaked an Apple Pay splash page last month, suggesting that Canadian banks may eventually support the mobile payments platform. High interchange fees and potential security issues have reportedly been sticking points in negotiations between Apple and banks.

Canada has been well prepared for Apple Pay, as many retailers and businesses across the country are equipped with NFC payment terminals required for contactless payments. The country was one of the earlier adopters of Chip-and-PIN debit and credit cards that can be tapped against a payment terminal when making a purchase, and Apple Pay is a natural extension of that functionality.

Canada's largest credit and debit card payment processor Moneris announced Apple Pay support for American Express cards earlier today.

Apple Pay launched in the U.S. in October 2014 and expanded to the U.K. last July, making Canada the third country with support for the service. Beyond Canada, Apple is also partnering with American Express to bring Apple Pay to four additional markets by the end of 2016.

Apple has confirmed with the Financial Post that Apple Pay will support American Express in Australia later this week, with AMEX customer service representatives suggesting a tentative November 19 launch date. Apple Pay will launch with American Express in Spain, Singapore and Hong Kong next year.

Update: Apple has published a list of Apple Pay participating retailers and apps on its Apple Pay page in Canada. Notable stores include Apple, Indigo, McDonald's, Petro Canada, Staples and Tim Hortons.

Top Rated Comments

Lets hope CBA, Westpac, NAB and ANZ get their act together soon, but for now this is great news for us Aussies.

Apple Pay is not just "chipped cards". It's not even "just NFC". It's the first implementation of an new specification from the EMV consortium that uses tokenization to eliminate the need to exchange the actual account number during an authorization or reconciliation. There are also other additional security features that protect the card holder, the merchant, and the bank -- and all exceed the security features of the chip, alone.

In the US, Apple's fee is reportedly 15 cents per $100. This has been posted multiple times in this thread. If implemented properly, the EMV tokenization eliminates an entire class of credit card fraud and will likely be a net gain for the bank.

But in any event, the fee is paid by the bank. It's not paid directly by the cardholder, although if it eventually becomes an additional net cost increase for the bank, it will be paid by all of the bank's customers and shareholders.