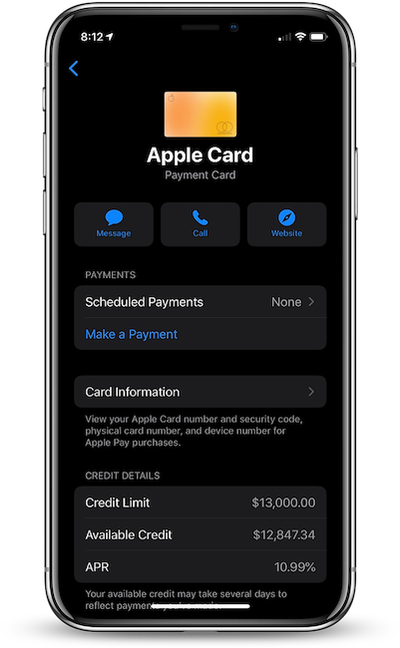

Apple Card's Base APR Lowered to 10.99% for Some Cardholders

Following two interest rate cuts by the U.S. Federal Reserve in March, the Apple Card's base APR has now decreased from 12.49 percent to 10.99 percent for some cardholders, including MacRumors reader Zed and others on Reddit.

This is at least the third time that the Apple Card's APR range has been lowered since the credit card launched in August 2019.

Due to current affairs, Apple recently launched a customer assistance program that allows Apple Card holders to skip their March and April payments without incurring interest charges. To enroll in the program, read Apple's support document.

Key features of the Apple Card include color-coded spending summaries in the Wallet app, no fees beyond any applicable interest, and up to three percent daily cashback.

To apply for an Apple Card, simply open the Wallet app on an iPhone running iOS 12.4 or later, tap the plus button in the top-right corner, and follow the on-screen steps. The process takes just a few minutes, and if approved, your digital Apple Card will be ready for purchases immediately. A physical titanium-based Apple Card is also available for use at retail stores that do not accept contactless payments.

Popular Stories

Apple will introduce new iPad Pro and iPad Air models in early May, according to Bloomberg's Mark Gurman. Gurman previously suggested the new iPads would come out in March, and then April, but the timeline has been pushed back once again. Subscribe to the MacRumors YouTube channel for more videos. Apple is working on updates to both the iPad Pro and iPad Air models. The iPad Pro models will...

In November, Apple announced that the iPhone would support the cross-platform messaging standard RCS (Rich Communication Services) in the Messages app starting "later" in 2024, and Google has now revealed a more narrow timeframe. In a since-deleted section of the revamped Google Messages web page, spotted by 9to5Google, Google said that Apple would be adopting RCS on the iPhone in the "fall...

Thieves in Montreal, Canada have been using Apple's AirTags to facilitate vehicle theft, according to a report from Vermont news sites WCAX and NBC5 (via 9to5Mac). Police officers in Burlington, Vermont have issued a warning about AirTags for drivers who recently visited Canada. Two Burlington residents found Apple AirTags in their vehicles after returning from trips to Montreal, and these...

Apple's WWDC 2024 dates have been announced, giving us timing for the unveiling of the company's next round of major operating system updates and likely some other announcements. This week also saw some disappointing news on the iPad front, with update timing for the iPad Pro and iPad Air pushed back from previous rumors. We did hear some new tidbits about what might be coming in iOS 18 and...

Photos of the first iPhone 16 cases have been shared online, offering another preview of the rumored new vertical rear camera arrangement on the standard iPhone 16 and iPhone 16 Plus. Image credit: Accessory leaker Sonny Dickson Over the last few months, Apple has been experimenting with different camera bump designs for the standard iPhone 16 models, all of which have featured a vertical ...

A $3 third-party app can now record spatial video on iPhone 15 Pro models in a higher resolution than Apple's very own Camera app. Thanks to an update first spotted by UploadVR, Spatialify can now record spatial videos with HDR in 1080p at 60fps or in 4K at 30fps. In comparison, Apple's native Camera app is limited to recording spatial video in 1080p at 30fps. Shortly after Apple's Vision ...

Top Rated Comments

The reason credit card interest rates are so high is because they are in fact loans without collateral, meaning that if you don't pay back what the bank is due, the bank has no asset it can take to recoup the losses. This is different e.g. compared to a loan for a house or car, where if you stop paying the bank has the option to repossess them, resell them and get at least some money back.

This means the bank has a higher risk of not getting back the money from those who don't pay, which means the interest rate is high compared to more secure forms of loan.