Apple Savings Account Lists Longer 5 Day Fund Transfer Time in iOS 17

Apple in the iOS 17 beta has changed the text that provides details on the Automated Clearing House (ACH) transfer time for Apple Savings account holders.

In iOS 17 beta 2, it now reads "Funds are typically available for withdrawal by the 5th business day" when a transfer is made. Prior to the beta, it said that transfers "typically take 1-3 business days to complete." The 1-3 day wording still exists in iOS 16.

The transfer time clarification comes after a number of complaints from Apple Card owners who opted into the Savings account when it became available. Apple Savings account users have had issues with long wait times when attempting to withdraw funds.

A June report from The Wall Street Journal shared stories from several customers who faced unexplained delays when making a withdrawal from an Apple Savings account. One customer even experienced a shocking 17-day delay before receiving their funds, with Goldman Sachs citing anti-fraud efforts.

The Apple Savings account initially launched in April as an extension of the Apple Card, in partnership with Goldman Sachs. The account promised a high-yield 4.15% savings option to customers, attracting many who wanted to capitalize on earning interest while staying in the Apple ecosystem. The account is managed through the Apple Wallet app, offering seamless integration with other Apple services.

It's unclear whether the extended transfer time is a permanent change or a temporary measure while Apple and Goldman Sachs work on resolving the issues behind the scenes.

Popular Stories

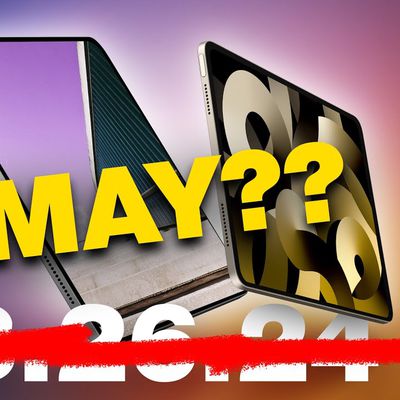

Apple will introduce new iPad Pro and iPad Air models in early May, according to Bloomberg's Mark Gurman. Gurman previously suggested the new iPads would come out in March, and then April, but the timeline has been pushed back once again. Subscribe to the MacRumors YouTube channel for more videos. Apple is working on updates to both the iPad Pro and iPad Air models. The iPad Pro models will...

In November, Apple announced that the iPhone would support the cross-platform messaging standard RCS (Rich Communication Services) in the Messages app starting "later" in 2024, and Google has now revealed a more narrow timeframe. In a since-deleted section of the revamped Google Messages web page, spotted by 9to5Google, Google said that Apple would be adopting RCS on the iPhone in the "fall...

Thieves in Montreal, Canada have been using Apple's AirTags to facilitate vehicle theft, according to a report from Vermont news sites WCAX and NBC5 (via 9to5Mac). Police officers in Burlington, Vermont have issued a warning about AirTags for drivers who recently visited Canada. Two Burlington residents found Apple AirTags in their vehicles after returning from trips to Montreal, and these...

Apple's WWDC 2024 dates have been announced, giving us timing for the unveiling of the company's next round of major operating system updates and likely some other announcements. This week also saw some disappointing news on the iPad front, with update timing for the iPad Pro and iPad Air pushed back from previous rumors. We did hear some new tidbits about what might be coming in iOS 18 and...

Photos of the first iPhone 16 cases have been shared online, offering another preview of the rumored new vertical rear camera arrangement on the standard iPhone 16 and iPhone 16 Plus. Image credit: Accessory leaker Sonny Dickson Over the last few months, Apple has been experimenting with different camera bump designs for the standard iPhone 16 models, all of which have featured a vertical ...

A $3 third-party app can now record spatial video on iPhone 15 Pro models in a higher resolution than Apple's very own Camera app. Thanks to an update first spotted by UploadVR, Spatialify can now record spatial videos with HDR in 1080p at 60fps or in 4K at 30fps. In comparison, Apple's native Camera app is limited to recording spatial video in 1080p at 30fps. Shortly after Apple's Vision ...

Top Rated Comments

My country (India) has its fair share of problems, but the money transfer is absolutely cutting edge. Free, instant and direct transfers between bank accounts (including inter-bank transfers) using QR codes or phone numbers. Additionally, it's so common and pervasive that street vendors have QR codes on their little make shift carriages. Cash is still pretty common, but UPI has really boosted the cashless story here. NPCI (government body responsible for this) keeps banks on a pretty tight leash regarding adherence to standards.