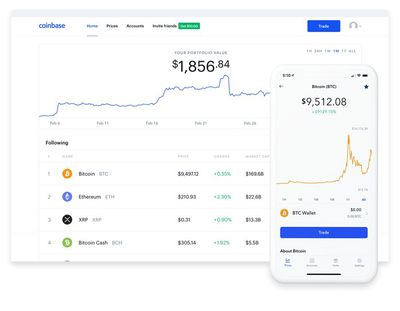

Coinbase Users Can Now Buy Crypto Assets Using Apple Pay

Popular cryptocurrency exchange Coinbase has announced that it is now allowing traders to use bank cards linked to Apple Pay to purchase crypto assets on the platform.

"Today, we're introducing new and seamless ways to enable crypto buys with linked debit cards to Apple Pay and Google Pay, and instant cashouts up to $100,000 per transaction available 24/7," said a Coinbase blog post on Thursday.

"If you already have a Visa or Mastercard debit card linked in your Apple Wallet, Apple Pay will automatically appear as a payment method when you're buying crypto with Coinbase on an Apple Pay-supported iOS device or Safari web browser."

In addition, Coinbase said it is also making it easier and faster for users to access their money by offering instant washouts via Real Time Payments (RTP), allowing customers in the U.S. with linked bank accounts to instantly and securely cash out up to $100,000 per transaction.

In June, Coinbase debit cards gained Apple Pay support, allowing it to be added to the Wallet app on iPhone. The Coinbase Card automatically converts the cryptocurrency that a user wishes to spend to U.S. dollars, and transfers the funds to their Coinbase Card for Apple Pay purchases and ATM withdrawals.

Popular Stories

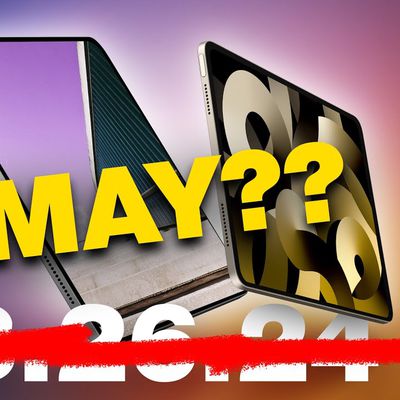

Apple will introduce new iPad Pro and iPad Air models in early May, according to Bloomberg's Mark Gurman. Gurman previously suggested the new iPads would come out in March, and then April, but the timeline has been pushed back once again. Subscribe to the MacRumors YouTube channel for more videos. Apple is working on updates to both the iPad Pro and iPad Air models. The iPad Pro models will...

In November, Apple announced that the iPhone would support the cross-platform messaging standard RCS (Rich Communication Services) in the Messages app starting "later" in 2024, and Google has now revealed a more narrow timeframe. In a since-deleted section of the revamped Google Messages web page, spotted by 9to5Google, Google said that Apple would be adopting RCS on the iPhone in the "fall...

Thieves in Montreal, Canada have been using Apple's AirTags to facilitate vehicle theft, according to a report from Vermont news sites WCAX and NBC5 (via 9to5Mac). Police officers in Burlington, Vermont have issued a warning about AirTags for drivers who recently visited Canada. Two Burlington residents found Apple AirTags in their vehicles after returning from trips to Montreal, and these...

Apple's WWDC 2024 dates have been announced, giving us timing for the unveiling of the company's next round of major operating system updates and likely some other announcements. This week also saw some disappointing news on the iPad front, with update timing for the iPad Pro and iPad Air pushed back from previous rumors. We did hear some new tidbits about what might be coming in iOS 18 and...

Photos of the first iPhone 16 cases have been shared online, offering another preview of the rumored new vertical rear camera arrangement on the standard iPhone 16 and iPhone 16 Plus. Image credit: Accessory leaker Sonny Dickson Over the last few months, Apple has been experimenting with different camera bump designs for the standard iPhone 16 models, all of which have featured a vertical ...

A $3 third-party app can now record spatial video on iPhone 15 Pro models in a higher resolution than Apple's very own Camera app. Thanks to an update first spotted by UploadVR, Spatialify can now record spatial videos with HDR in 1080p at 60fps or in 4K at 30fps. In comparison, Apple's native Camera app is limited to recording spatial video in 1080p at 30fps. Shortly after Apple's Vision ...

Top Rated Comments

Everything in crypto is just a ponzi scheme (and a bit like a pyramid scheme). You own a crytocurrency? You hype it up blindly in order to get more buyers. Then you exit for a profit. Anyone saying cryptocurrency is useful or is the future is only saying that to drive hype, thus price, before exiting.

14 years later, crypto hasn't done anything useful except enabling money laundering and buying illegal things. Not only that, it wastes energy (green or not) and hundreds of thousands of people talent that could have gone into solving more pressing problems in the world.

What cryptocurrencies are is just a modern, efficient way of creating and exiting scams. Cryptocurrencies take advantage of social media to spread and the fact that there is a lot of cash looking for "investments" due to our current low interest-rate environment.

Unlike owning things like stocks where the entities must have boards, report financials, have audits, disclose risks, crypto companies can raise $100 million and then completely shut down the next day without any repercussions except getting a few angry tweets from investors. Once you give money to a crypto project, the founders can do whatever the hell they want.

People say blockchain doesn't have a "killer application" yet. Actually, it does. Its killer application is scamming.

There is a reason why a significant portion of crypto companies are registered in the Cayman Islands.

I wish the U.S. and EU would just grow a pair and ban all crypto like China did.

For a blockchain, you can only pick 2 of the 3 following: decentralization, security, and performance.

Bitcoin is very decentralized (copies of the blockchain in millions of computers) and has good security (mining). But it can only perform 4.6 transactions per second because mining is incredibly computationally intensive and the blockchain is spread across millions of computers.

Compare this to Visa. Visa prioritizes security and performance. It's centralized. For simplicity of explaining this, Visa transactions only need be verified by Visa, probably using a high-performance centralized Oracle database. This allows Visa to handle 24,000 transactions per second and this limit can easily increase with more CPUs and servers.

All cryptocurrencies just turn the dial between decentralization, security, and performance. Any magical new blockchain that promises "100000x" the performance of Bitcoin is just less decentralized with less security. These blockchains are usually easily manipulated. In fact, there's a website dedicated to calculating how much it costs to attack them: https://www.crypto51.app/

Any cyrptocurrency that wants to process as many transactions as Visa will basically have to use a system very similar to Visa's which means it's no different than Visa. And we already have a Visa (and many other legitimate financial companies).

Hence, Bitcoin is just "digital gold" or something that does nothing except sit there and drain up a country's worth of energy.

There are very complex financial systems growing around the trading & exchanging of Cryptos, especially over the past 2 years. If a crypto coins future potential-use was as clear as day then absolutely everyone would be jumping onboard overnight, destabilising the market.

However there is slowly but surely heavy investment being poured into setting up infrastructure and governance systems that are facilitating crypto’s growth and I can’t see that it’s all being done simply to profit from some hype bubble.

I don’t think anyone knows with absolute certainty what the use-case will be for all these intangible digital coins all with their own tokenomics at play, however enough people believe that there will be a radical shift to their use over fiat and other commodities in the trading of value in the future.

I think you’re judging it too harshly too early, in the scope of a millennium of technologically advanced civilisation, a decade is nothing really. There is a future somehow for these digital coins.

This is the third person who refuses to address any of my points except to resort to ad hominem.

Quote my arguments and provide your counterargument. Let's debate.

Before, gold was the backer for cash, but ultimately it has no intrinsic value these days. The banks just print more when needed. It's backed by no asset so just like crypto, it can fluctuate and the price can be manipulated easily.

And you trust your government with your money?

Take Cyprus as an example. (All bank deposits over €100k were seized no matter how legit your money was).

Take Spain as an example. (The tax office can seize money without warning at their discretion)

Governments can manipulate currency to their hearts' content.

The point of decentralization is to protect against this. That's why it carries value.